|

Current Housing Fear Index (HFI) Chris Waltzek August 16, 2012

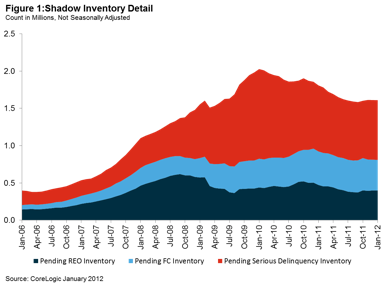

Figure 1.1. US Shadow Inventory 2006-2012

2006 HFI = 124,600,000

+ 400,000 * $192,300 / 8,500,000M = 2.83

2012 HFI

= 131M + 1,500,000 * $168,000 / 14,750,000M

= 1.51

2012 HFI

= 2.5M + 1,500,000 * $? / 14,750,000,000,000

= 5%

2012 HFI

= 2.5M + 1,500,000 * $? = 5% * 14,750,000,000,000

2012 HFI

= 2.5M + 1,500,000 * $? = 737500090000

2012 HFI

= 2.5M + 1,500,000 * $? = 737,500,090,000

/ 4,000,000

2012 HFI

= $? = 737,500,090,000 / 4,000,000 =

2012 HFI

= $ = $184,375

Alpha Gold Stocks Beats the XAU/GDX 44% *Special thanks to James Turk and goldmoney.com for the use of the Gold Fear Index calculation. PLEASE

READ CAREFULLY - Disclaimer:

Information provided must not be construed as a recommendation

to buy or sell any security or financial instrument, or to participate

in any particular trading or investment strategy. The author /

editor of this web site has not been paid by any company or service

to promote the stock picks. All stocks are chosen entirely due

to technical / fundamental characteristics. Any action taken as

a result of information, analysis, or advertisement is ultimately

your responsibility. The host and author is not a paid adviser.

Investing in high alpha stocks involves substantial risk. Past

performance is no guarantee of future returns. Consult your investment

adviser before making any investment decisions. Investors are

advised to apply only a fraction of their total portfolio, less

than 2% to the total of all picks. Only RISK CAPITAL should be

used due to the high volatility associated with

such investments. None

of the stock information, data and company information presented

herein constitutes a recommendation or a solicitation of any offer

to buy or sell any securities. Information

presented is general information that does not take into account

your individual circumstances, financial situation, or needs,

nor does it present a personalized recommendation to you. Individual

stocks presented may not be ideal to your investing objectives.

Although information has been obtained from and is based upon

sources believed to be reliable, we do not guarantee its accuracy

and the information may be incomplete or condensed. All opinions

and estimates constitute judgments contingent upon the date of

the report and are subject to change without notice. This report

is for informational purposes only and is not intended as an offer

or solicitation for the purchase or sale of a investment security.

Past

performance is no indication of future results.

ęGold Seek LLC & ęChris Waltzek 2010-2011. All Rights Reserved. |