©Gold

& Silver Fear Indexes

Current

Gold Fear Index (GFI)

August

16, 2012

Chris

G. Waltzek

A

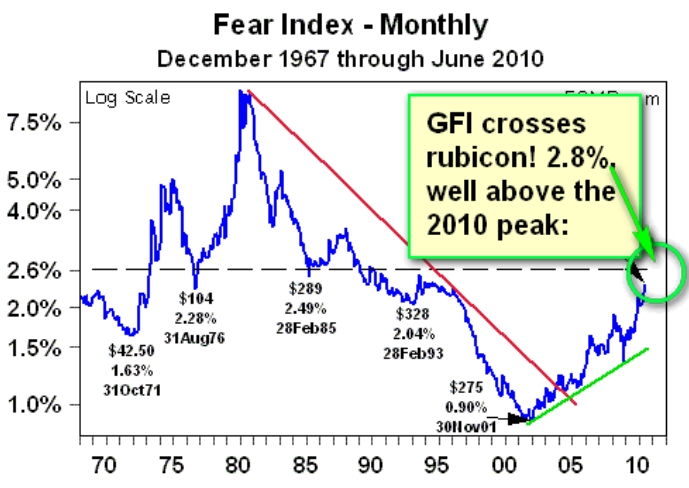

discussion

with James Turk this week renewed my interest in

his Fear Index. So I decided to calculate the current

figure. Given the 2.8% GFI figure listed in the equation

above, clearly the gold market mania phase is only beginning,

when compared to the 1980's peak:

(Courtesy

of GoldMoney.com) (Courtesy

of GoldMoney.com)

GFI

Formula (click

links for data sources):

GFI

= 261,500,000 * $1,600 / 14,750,000,000,000 = 2.8%

Next

we use the formula to extrapolate a gold price forecast.

The chart shows the Fear Index apogee of roughly 9% in

1980. So we plug in a new gold price of $5,000 which results

in 9% GFI reading.

GFI

= 261,500,000 * $5,000 / 14,750,000,000,000

= 9%

Thus

according to the GFI, the fair value for gold is $5,000.

Keep in mind that the gold price forecast moves higher

as the M3 money supply figure increases. For instance,

if we assume the M3 climbs to the number listed below,

in accordance with expectations, gold could soar above

$5,000, to $7,000:

GFI

= 261,500,000 * $7,000 /

20,000,000,000,000 = 9%

NEW:

Current Silver Fear Index (SFI)

Updated: September

13, 2012

Formula

(click links for data sources):

The

GFI index can be used to determine the fair value of silver,

by simply using the gold/silver ratio. Assuming a GFI figure

of $5,000 and a gold/silver ratio of 50, the expected silver

price is: $5,000 / 50 = $100. However, to derive a more

accurate silver estimation, we apply the GFI formula to

the silver market, resulting with a new indicator: the silver

fear index (SFI). Since the government has sold off the

strategic silver stockpile, all three billion ounces and

the US Mint must purchase silver from the free market, the

silver market balance figures produced by the CPM

Group are used. This figure represents the annual silver

inventories. First we calculate the SFI for the 1980's peak

price of $50 to use as a base for common size measurement:

.54%. Next we calculate the current SFI: .04%.

Clearly the silver price is EXTREMELY undervalued relative

to 1980. But precisely how undervalued is silver, relative

to the 1980's peak?

SFI

= 210,000,000 * $50 / 1,935,100,000,000 = .54%

SFI

= 200,000,000 * $30 / 14,750,000,000,000 = .04%

To

determine how undervalued silver is today relative

to the previous bull market peak price, the .54%

SFI number from the 1980 calculation is substituted

into the 2012 equation:

SFI

= 200,000,000 * $Silver? / 14,750,000,000,000

= .54%

SFI

= 200,000,000 * $Silver? = .54%

*14,750,000,000,000

SFI

= 200,000,000 * $Silver? = 79650000000

SFI

= $Silver? = 79650000000

/ 200,000,000

NEW:

Therefore,

the SFI indicates that silver must climb to nearly

$400 in order to reach it's current fair value.

Anecdotally, this is precisely the silver target

I proposed in Wealth Building Strategies (2010).

Nevertheless, the $400 price is likely overstated

due to the fact that gold has not been included

in the calculations. Next the GFI and SFI indexes

are combined and adjusted by gold relative to silver

(50 = 49/50 = .98) and silver relative to gold (1/50

= .02) resulting with a current silver estimate:

Silver

FV = GFI ($5,000) + SFI

($398) = $5,398 * Silver:Gold (1/50) =

$108

Gold

FV = GFI ($5,000) + SFI

($398) = $5,398 * Gold:Silver(49/50) =

$5290

So

investors should expect silver to climb to $108

and gold to $5,398

per ounce. Although the numbers listed above

are close approximations, for a more accurate calculation

of the gold and silver fair value estimates, the

GFI and SFI formulas must be combined within the

original M3 money supply computation. This article

is dynamic - the formulas will be updated after

this semester is over. Please click this link for

the Housing Fear Index (HFI): click

here.

|

|

PLEASE

READ CAREFULLY - Disclaimer: Information provided must

not be construed as a recommendation to buy or sell any

security or financial instrument, or to participate in any

particular trading or investment strategy. The author /

editor of this web site has not been paid by any company

or service to promote the stock picks. All stocks are chosen

entirely due to technical / fundamental characteristics.

Any action taken as a result of information, analysis, or

advertisement is ultimately your responsibility. The host

and author is not a paid adviser. Investing in high alpha

stocks involves substantial risk. Past performance is no

guarantee of future returns. Consult your investment adviser

before making any investment decisions. Investors are advised

to apply only a fraction of their total portfolio, less

than 2% to the total of all picks. Only RISK CAPITAL should

be used due to the high volatility associated with such

investments. None

of the stock information, data and company information presented

herein constitutes a recommendation or a solicitation of

any offer to buy or sell any securities. Information

presented is general information that does not take into

account your individual circumstances, financial situation,

or needs, nor does it present a personalized recommendation

to you. Individual stocks presented may not be ideal to

your investing objectives. Although information has been

obtained from and is based upon sources believed to be reliable,

we do not guarantee its accuracy and the information may

be incomplete or condensed. All opinions and estimates constitute

judgments contingent upon the date of the report and are

subject to change without notice. This report is for informational

purposes only and is not intended as an offer or solicitation

for the purchase or sale of a investment security. Past

performance is no indication of future results.

|

| |

©Gold

Seek LLC

|

|